Investment

Diamonds?

By Mark I. Sikand

Really? Well, today, more and more companies are advertising

on Social media, the radio, TV and the Internet. But who is buying

"Investment Diamonds", what is an "Investment Diamond" and

how much should a person, an Investor, pay for such a

diamond.? Answer, "retail Customers and they are paying top

dollar.

For me, and many others, an "Investment Diamond" is any

diamond that you can buy and then sell and make a profit.

The more in demand that diamond is, the easier and faster

you will be able to liquidate it and make a profit, as long

as you did not over pay for it. Remember, it is not always

about just the price. Some diamonds are just not in demand.

Buying "Investment Diamonds" is not like buying shares of

stock or a commodity that has a set price. When it comes to

buying Investment diamonds there is no pricing structure and

many, but not all, consumers are going to get ripped off big

time and be very disappointed when they try to resell.

Most of the companies selling Investment Diamonds have great

material to send you, great websites and highly skilled and

trained sales people who will contact you. The hype and the

promises of a 15% - 20% annual return on your investment are

very impressive. However, when push comes to shove and you

read the fine print, it usually indicates that you have

little to no hope of making a profit at all when you sell.

Selling your Investment diamond, when you need the cash, can

be a real problem and nightmare. Simply put, a diamond is

not very liquid at all. Even worse, if you over paid

for it and you need the cash now, you will realize a huge

financial loss.

On a more positive note, if you buy the right diamonds and

you pay the right price, you will most likely do well and

turn a profit. The problem is, how do you know? What should

you buy and how much should you pay? There are a lot

of dishonest and misleading companies out there so be

careful.

Here are a few ideas for you. 1) Ask the company if they

will buy the diamond back from you. If they say "yes" or "we

will work with you to help you sell it", Ask for at least 10

current references. If they say that that information is

confidential, then you need to walk away. 2) Find out which

company certifies the quality of the Investment Diamond,

make sure that it is either the GIA or the AGS. If it is NOT

then you need to walk away. 3) Find out the specific size

and quality of the diamond and do some competitive price

shopping. If they refuse to tell you it's because they are

overcharging you. Do not let them pressure you into make an

instant decision or giving them a deposit.

There is a lot of information about Investment Diamonds

available to you on the Internet. Make sure that you do your

research before you make any decision.

MAKE SURE THAT YOU USE

TheBuyReport.com to check diamond prices. Try the 10 day

FREE trial.

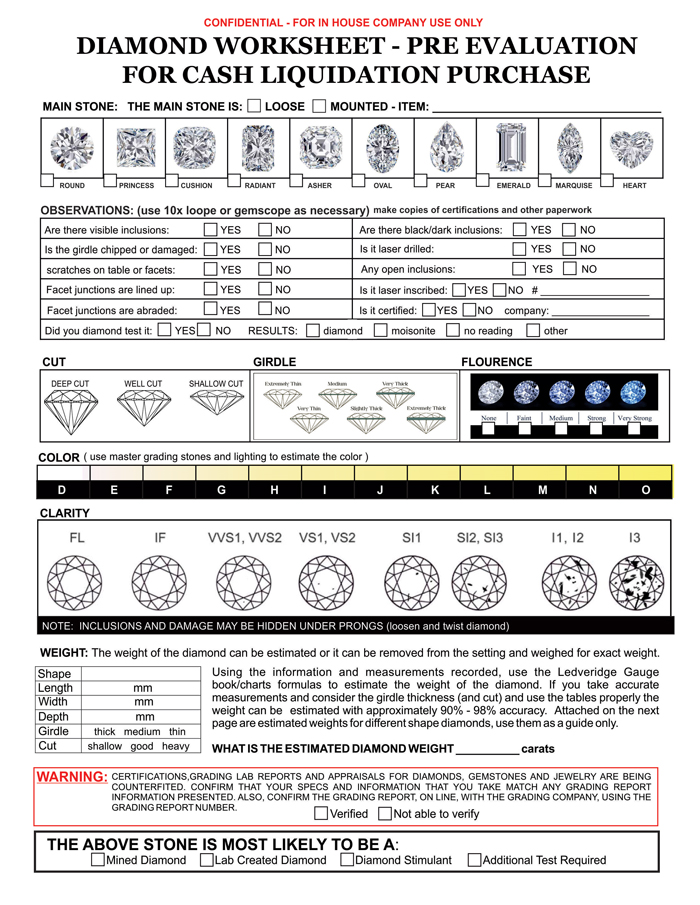

Buying Diamonds Off The

Street

Retail jewelers, diamond dealers and

private independent diamond buyers have a NEW wholesale

source for buying diamonds - The Public.

Are you or is your company advertising that you

buy diamonds from the public? Why NOT? Are you afraid

because you don't know how? Or is it because business

is so bad that you don't have the working capital and you

are embarrassed ? Well, need to keep reading.

As a means for survival, additional revenue and huge

profits, successful and smart jewelers have learned how

important it is become sharp professional diamond buyers and

be better that their competitors. Why? Because they want and

need to make the purchase..... MONEY and PROFIT. And they

don't want the customer to walk and lose the opportunity to

buy the diamond at a fraction of the actual wholesale price.

If that customer walks, you know that they are never coming

back. And if you have insulted the customer with your "Buy

Presentation" or your "Buy Offer", you know that they

are going to tell their friends and family what a rip-off

and idiot you are. We have all been there and it hurts

because we know that we will lose a lot of future

customers, opportunity and profits.

Just as there is and art, talent and skill to SELLING

diamond to retail customers, there is an art, talent and

skill to BUYING diamonds off the street from private

consumers who want to liquidate.

Consumers who are selling an important diamond are smart,

they have done research, they know the approximate wholesale

price and they know what they paid for it (retail price).

Most likely they have already received offers from other

professional diamond buyers. If you are their first stop for

a price quote, don't expect them to just sell to you at your

lowball offer, they will not. The price that you quote for

the diamond needs to be a sharp fair market cash liquidation

price.

You NEED to know what you are doing. You need to know how to

work the customer, your presentation needs to be

professional and you need to know what price to offer your

customer. You NEED to invest the few dollars and take the On

Line training program

"How To

Buy Diamonds Off The Street" and if you have employees

they need to take it also. As for what price to offer for

the diamond, use the "Cash Liquidation Price Chart"

offered here on

TheBuyReport.com. , the subscription price is not

expensive or you can try the FREE TRIAL OFFER.

|

|

|

|

Have You Ever

Tried To Sell Your Diamond?

By Edward Jay

Epstein

The diamond invention—the creation of the idea that diamonds

are rare and valuable, and are essential signs of esteem—is

a relatively recent development in the history of the

diamond trade. Until the late nineteenth century, diamonds

were found only in a few riverbeds in India and in the

jungles of Brazil, and the entire world production of gem

diamonds amounted to a few pounds a year. In 1870, however,

huge diamond mines were discovered near the Orange River, in

South Africa, where diamonds were soon being scooped out by

the ton. Suddenly, the market was deluged with diamonds. The

British financiers who had organized the South African mines

quickly realized that their investment was endangered;

diamonds had little intrinsic value—and their price depended

almost entirely on their scarcity. The financiers feared

that when new mines were developed in South Africa, diamonds

would become at best only semiprecious gems.

The major investors in the diamond mines realized that they

had no alternative but to merge their interests into a

single entity that would be powerful enough to control

production and perpetuate the illusion of scarcity of

diamonds. The instrument they created, in 1888, was called

De Beers Consolidated Mines, Ltd., incorporated in South

Africa. As De Beers took control of all aspects of the world

diamond trade, it assumed many forms. In London, it operated

under the innocuous name of the Diamond Trading Company. In

Israel, it was known as "The Syndicate." In Europe, it was

called the "C.S.O." -- initials referring to the Central

Selling Organization, which was an arm of the Diamond

Trading Company. And in black Africa, it disguised its South

African origins under subsidiaries with names like Diamond

Development Corporation and Mining Services, Inc. At its

height -- for most of this century -- it not only either

directly owned or controlled all the diamond mines in

southern Africa but also owned diamond trading companies in

England, Portugal, Israel, Belgium, Holland, and

Switzerland.

De Beers proved to be the most successful cartel arrangement

in the annals of modern commerce. While other commodities,

such as gold, silver, copper, rubber, and grains, fluctuated

wildly in response to economic conditions, diamonds have

continued, with few exceptions, to advance upward in price

every year since the Depression. Indeed, the cartel seemed

so superbly in control of prices -- and unassailable --

that, in the late 1970s, even speculators began buying

diamonds as a guard against the vagaries of inflation and

recession.

The diamond invention is far more than a monopoly for fixing

diamond prices; it is a mechanism for converting tiny

crystals of carbon into universally recognized tokens of

wealth, power, and romance. To achieve this goal, De Beers

had to control demand as well as supply. Both women and men

had to be made to perceive diamonds not as marketable

precious stones but as an inseparable part of courtship and

married life. To stabilize the market, De Beers had to endow

these stones with a sentiment that would inhibit the public

from ever reselling them. The illusion had to be created

that diamonds were forever -- "forever" in the sense that

they should never be resold.

continue -

CLICK HERE

Professional Diamond

Buyer Training Fall 2012, MIS

With today's economy

and competitive markets, PROFESSIONAL Diamond Buyer Training

may be more important than PROFESSIONAL Sales Training. On

the back end of our industry (buying off the street) there

is big money and profits to be made .... and today, with

soft retail sales, we need that back end money and profits

more than ever. We provide you, your employees and your

company with that necessary PROFESSIONAL Buyer Training. That's what we do. We know

how the top most successful Buyers and Companies operate, and they

are professional and good. No matter how much experience you have or

how good you think you are, our goal is to make you even better so

that you earn the customers trust and confidence and you win the

BUY. You need to be better.

"How To Buy Diamonds Off The

Street", an exclusive industry training program, will help you

make money and increase your revenues and profits. In today's

economy, big companies, small companies, existing jewelers and

private individuals have sharpened their professional buying skills

and are buying more and more diamonds and fine jewelry off the

street, and they are making big money. It will help you purchase

fine quality diamonds at approximately 1/5 - 1/2 of current

wholesale prices. Then, you can sell it retail and increase your

margin or you can flip it on the wholesale end and still make big

money.

Professional Buyer Training, to buy,

is just as important as professional sales training, to sell.

Don't think for one minute that a consumer who has a GIA

certificated 1.04 carat G VS1 round diamond ex, ex, none is going to

just walk up to you and sell you the diamond for $2,000.00. In

today's economy it's just not going to happen. The consumer is going

to check prices on the Internet and then go to 3 - 5 professional

diamond buyers. Whoever makes the best and most professional

presentation and offers a fair cash liquidation price will end up

buying that diamond. And, they will make good money when they flip

it or retail it. They will most likely end up paying about

$2,800. - $3,500. Then, they will retail it and make a huge profit

margin or they will flip it on the wholesale end, a few days later,

and make $1,500 - $3,000 profit.

For every

ten (10) customers who come to you to sell their diamonds, what is

your closing ratio or successful buying percentage. Most likely 1 -

2 out of 10 or 10% - 20%. Well, what if it were 40% - 60% OR MORE

and you paid a fair market cash liquidation price? How good would

that be? Big money, big profits!!!!

LEARN MORE -

CLICK HERE |

|

|

|

Which Diamond Grading Certificate is Best?

Don’t Buy the Certificate!

February 10th, 2010 by James L. Sweaney,

CGA, FGA. GG

We posted this about a

year ago–with the tough economy, this

insider information is more pertinent than

ever, so we’ve tweaked the original blog a

bit–here it is again.

In their quest for the best value, consumers

looking to buy a diamond often make the

mistake of giving equal weight to diamond

grading certificates. Diamond grading

certificates/reports are issued by various

laboratories for the purpose of identifying,

measuring and weighing, and grading a

particular diamond. These reports are

not appraisals.

One problem is that even though the various

labs all use the diamond grading

system/language developed in the 1950′s by

the Gemological Institue of America (GIA),

each lab has its own internal methods,

standards, experience and skill levels.

Another issue is independence. The GIA

decided early on that their lab should be a

disinterested third party, independent of

the buying and selling of the gems. To this

day, GIA is very careful to maintain the

“arms length’ rule and does not participate

in buying, selling, or appraising diamonds

or colored gemstones in any way. However,

all labs, including GIA, do charge for their

expert grading services–the fees are usually

paid by the diamond merchants who own the

stones.

Many of the other labs are profit making and

some are closely affiliated with the firms

for whom they grade diamonds–and this

relationship is not always apparent to the

ultimate consumer. The important thing to

remember is that even though diamond grading

reports/certificates may look very similar,

but the quality

of the information can vary

significantly. Our case history reported

below shows just how much this disparity can

mean in dollars.

Consumers tend to shop by comparing prices

using the grades stated on grading

certificates as their basis of

comparison–the internet makes it very easy

to do this. The grading reports all look the

same and have what appears to be the same

information, so this seems like a fool proof

way to shop prices.

A stone

graded SI1 F by one grading laboratory sells

for 30% less than a stone of similar weight

graded SI1 F by another grading laboratory,

so you buy the less expensive stone. You’d

be stupid to spend more than you have to,

right? The grading paper says it’s the same

as these other stones, must be true, lots of

dollars, good deal, right?

Wrong! We

call this “Buying the Certificate.” The case

history of an insurance appraisal we did of

a 3-carat round diamond and ring shows just

how much a diamond grading certificate can

affect the price of a diamond.

During the

take-in procedure and before looking at the

grading report, I gave this particular stone

a preliminary grade of SI2 clarity, H or

possibly I color. The stone was nicely cut,

but the inclusions within were positioned so

that they reflected throughout the stone,

much like a kaleidoscope. In diamond

grading, we call this a “reflector” and

usually deduct 1/2 to 1 clarity grade

depending on the impact of the reflections.

And the stone had a somewhat darkish look

overall.

So I was

really surprised when the client disclosed

that he had purchased the stone as

“colorless” (the range of D-F) and that it

had a grading certificate from EGL showing

the clarity as SI1 and the color as F. Turns

out he had purchased the stone from a dealer

in downtown LA who assured him that it was a

really super deal at $35,000 for the ring

and who gave him a “feel good” appraisal for

$72,000.

My

research of comparable items actively being

marketed showed the current wholesale prices

for well cut 3 ct. round SI1 F diamonds

graded by EGL labs

ranged from $7,950 to $10,100 per carat and

averaged about $9100 per carat. Multiply 3

cts x $9100, add 26% markup on the diamond,

about $2000 for the 18K ring and voila! —My

appraisal was for $36,500, within 4% of what

he said he paid

A survey

of well cut 3 ct round diamonds graded SI1 F

by GIA averaged

about $13,600 per carat—almost 50% more. I

also checked prices for well-cut 3 ct rounds

graded by GIA as SI2 H color (my original

grading). What do you know – the price range

of the 39 SI2 H stones I checked was $7,350

to $10,080 per carat! Virtually the same

price range as the stones graded SI1 F by

EGL.

The lesson

is that the market knows the reality–diamonds

are what they are, regardless of what a

piece of paper says. My years as a

professional diamond grader and

diamond-grading supervisor at the

Gemological Institute of America (GIA) told

me that this stone should not be graded SI1

F. The marketplace confirmed what I knew to

be true.

As sellers

of diamonds, we at Mardon always recommend

diamonds graded by GIA or AGS because we

know the quality of their work. Their

grading is the most consistent and the most

conservative. These are the two labs most

respected in the marketplace, period.

Moral of

the story–When you buy a diamond, don’t

make the mistake of buying the certificate.

Don’t just look for the lowest price.

Look at the stone, and if you can, compare

it with a similar stone side by side. Most

importantly, work with a diamond

professional, preferably an experienced

gemologist who can help you play the grading

certificate game and win!

|